How It Works: Simple, Transparent & Secure

Getting connected with a lender through our platform is fast, easy, and secure. Whether you’re exploring personal loan options to cover unexpected expenses or consolidate debt, our goal is to make the process stress-free and transparent.

Step 1: Fill Out a Quick & Secure Form

We start with a simple online form that asks for basic information like:

- Your desired loan amount

- Your email address

- Employment or income details

- Basic contact info

This form is 100% free and does not obligate you to accept any loan offer. It allows our network of partnered lenders to understand your financial needs and determine if they can assist you.

💡 Your data is securely handled in accordance with our Privacy Policy.

Step 2: We Match You With Available Offers

After completing the form:

- Your information is reviewed by multiple lenders in our network.

- You may receive one or more loan offers, depending on lender availability and your eligibility.

- You’ll be directed to view the full loan terms and conditions on the lender’s official site.

We do not guarantee approval or specific loan amounts—but we work with a wide network of financial service providers who may be able to help.

Step 3: Review & Accept Terms

If matched with a lender, you’ll be able to:

- Review the loan offer in detail

- Understand the total repayment amount, interest rate, and any applicable fees

- Decide whether the offer meets your needs

Accepting the loan is completely optional. We encourage users to carefully evaluate all terms before proceeding.

Step 4: Funds May Be Transferred to Your Account

If you agree to the lender’s terms and are approved:

- The lender will finalize your application

- Funds may be transferred to your bank account—sometimes as soon as the next business day (depending on lender policies and banking hours)

Please note: Speed of transfer can vary. Always verify this directly with your lender.

How the Process Works – Simple, Secure, and Fast

Our goal is to make it as easy and transparent as possible for you to get connected with a lending partner. Here’s a detailed breakdown of how the process works, step by step:

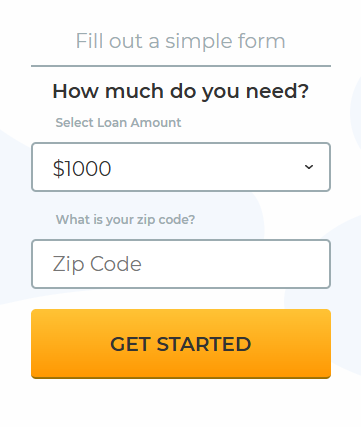

i. Fill Out a Quick and Secure Online Form

We begin with a simple inquiry form designed to collect the basic information required to match you with potential lending partners. The form will ask you to select your desired loan amount and provide your email address so we can contact you with next steps.

Once you enter the requested details and submit the form, you confirm your agreement to our Privacy Policy and Disclaimer. These policies are in place to ensure your information is handled responsibly and your rights are protected throughout the process.

This form is just an initial step—it does not commit you to a loan. Instead, it helps us start the process of connecting you with one or more lenders that may meet your financial needs.

ii. Let Our Lender Network Review Your Information

After you submit your form, our system securely shares your details with our network of trusted lending partners. These lenders independently review your information and determine if they can extend a loan offer to you based on their own internal criteria.

Because we work with multiple lenders, you may receive more than one offer—providing you the benefit of comparison. This process happens quickly, often within minutes, and enables you to review various loan products with different rates and terms.

We act solely as a connector—our role is to make the introduction, and the actual loan decision and terms come from the lender.

iii. Receive and Compare Loan Offers (If Available)

If one or more lenders are willing to extend you a loan, you’ll receive those offers through a secure online platform. These offers will include important details such as:

- The total loan amount

- Interest rate or APR

- Repayment schedule and term length

- Applicable fees or charges

- Payment due dates

You’ll have the opportunity to review all the offers carefully and choose the one that best fits your needs and budget. There’s no obligation to accept any offer, and you are encouraged to read all the terms thoroughly before making a decision.

iv. Get Matched with a Lender Who Can Fund You Fast

Once you accept an offer, you’ll be directed to the lender’s website where you can complete the final steps. This may involve providing some additional documentation or electronically signing the loan agreement.

In many cases, once you finalize the agreement, the lender may be able to deposit the funds directly into your bank account as quickly as the next business day. The exact timing de

✅ Why Use Our Service?

We’re not a lender—we’re a loan connection platform. That means:

- We don’t make loan decisions or issue funds

- We connect you with potential lenders who can

- Our service is 100% free to use

Key Benefits:

- 🕒 Save Time – Fill out one form instead of applying individually with multiple lenders.

- 🔒 Secure & Private – Your personal data is encrypted and never sold.

- 📝 No Obligation – Review offers risk-free. Accept only if you’re comfortable.

- 🌐 Nationwide Lender Network – Access a broad range of lenders across the U.S.

⚠️ Important Disclosures

Transparency matters. Before using our service, please read the following:

- We are not a lender and do not make credit decisions.

- Loan terms vary based on your credit profile, income, and lender criteria.

- No guaranteed approval – submitting a form does not guarantee that you will be connected with a lender or receive an offer.

- Loan amounts typically range from $1,000 to $35,000. The actual amount depends on the lender and your qualifications.

- Not available in all states. Some services may not be offered where prohibited by law.

🔍 Frequently Asked Questions

Who can use this service?

To use our service, you must:

- Be at least 18 years old

- Be a U.S. citizen or legal resident

- Have a valid checking account

- Have a steady source of income

Will using your service affect my credit score?

Most of our lenders conduct a “soft credit check” during the pre-qualification process, which does not affect your credit score. If you proceed with a loan offer, a “hard credit check” may be conducted by the lender before final approval.

How quickly can I receive the funds?

Some lenders can deposit funds as soon as the next business day. Timing depends on your bank, the lender’s process, and when you complete your application.

Can I apply if I have bad credit?

Yes, some of our partnered lenders consider applicants with less-than-perfect credit. However, loan terms (such as interest rates and repayment length) may differ based on creditworthiness.

Do I have to accept the loan?

No. Submitting your information only helps match you with potential lenders. You are under no obligation to accept any offer.

How the Process Works – Simple, Secure, and Fast

Our goal is to make it as easy and transparent as possible for you to get connected with a lending partner. Here’s a detailed breakdown of how the process works, step by step:

1. Fill Out a Quick and Secure Online Form

We begin with a simple inquiry form designed to collect the basic information required to match you with potential lending partners. The form will ask you to select your desired loan amount and provide your email address so we can contact you with next steps.

Once you enter the requested details and submit the form, you confirm your agreement to our Privacy Policy and Disclaimer. These policies are in place to ensure your information is handled responsibly and your rights are protected throughout the process.

This form is just an initial step—it does not commit you to a loan. Instead, it helps us start the process of connecting you with one or more lenders that may meet your financial needs.

2. Let Our Lender Network Review Your Information

After you submit your form, our system securely shares your details with our network of trusted lending partners. These lenders independently review your information and determine if they can extend a loan offer to you based on their own internal criteria.

Because we work with multiple lenders, you may receive more than one offer—providing you the benefit of comparison. This process happens quickly, often within minutes, and enables you to review various loan products with different rates and terms.

We act solely as a connector—our role is to make the introduction, and the actual loan decision and terms come from the lender.

3. Receive and Compare Loan Offers (If Available)

If one or more lenders are willing to extend you a loan, you’ll receive those offers through a secure online platform. These offers will include important details such as:

- The total loan amount

- Interest rate or APR

- Repayment schedule and term length

- Applicable fees or charges

- Payment due dates

You’ll have the opportunity to review all the offers carefully and choose the one that best fits your needs and budget. There’s no obligation to accept any offer, and you are encouraged to read all the terms thoroughly before making a decision.

4. Get Matched with a Lender Who Can Fund You Fast

Once you accept an offer, you’ll be directed to the lender’s website where you can complete the final steps. This may involve providing some additional documentation or electronically signing the loan agreement.

In many cases, once you finalize the agreement, the lender may be able to deposit the funds directly into your bank account as quickly as the next business day. The exact timing depends on the lender’s process and your bank’s policies.

Credit Score Ranges Explained

Although the specifics can get very complex, there are a few basic rules you should learn about how credit scores work.

No matter where or how you obtain your score, the ranges are typically separated into the following categories:

- 300 – 629: Poor

- 630 – 689: Fair or Average

- 690 – 719: Good

- 720 and above: Excellent

Keep in mind these are rough ranges, and every lender will have their own approach to how they view your score. Lenders usually rely on FICO for scoring, though some may use other models.

FICO scores generally range from 300 to 850, with an average around 700. Other models, such as those used by auto lenders or credit card issuers, might range from 250 to 900. It’s important to know which model your lender is using when checking your score.

Another scoring model gaining popularity is VantageScore, which also ranges from 300 to 850. It tends to have an average around 675.

How Do You Stack Up?

Understanding how your score compares to the general population can help you set goals. Here’s a quick breakdown:

FICO Score Distribution:

- Below 500: 4.7%

- 500s: 15.3%

- 600s: 23.2%

- 700s: 36.1%

- 800 and above: 20.7%

VantageScore Distribution:

- Below 500: 4.4%

- 500s: 21.6%

- 600s: 27.5%

- 700s: 27.1%

- 800 and above: 15.3%

Even though scores across systems are usually similar, they may not be identical. A 735 on FICO might translate to a 700 on VantageScore. Such differences are common and usually not a cause for concern.

However, large gaps could signal errors or differing interpretations of your credit history.

What Does the Number Mean?

Your credit score directly affects your access to credit products. A lower score can result in higher interest rates, fewer options, or even denial of credit. It may also impact non-credit-related services like insurance rates or utility deposits.

A high credit score typically leads to better rates, lower fees, and more favorable terms. For example, consumers with scores above 750 might qualify for promotional offers like 0% interest.

How to Get Your Score

Checking your score is easier than ever. Many websites and financial institutions offer free access to your credit score. Popular platforms like CreditKarma give you an estimate and also track changes over time.

You can also go directly to the three major credit reporting agencies: Experian, TransUnion, and Equifax. Regularly checking your score can help you identify errors early and catch signs of identity theft.

Tracking Credit Score Progress

To make tracking easier, stick to one scoring model. Switching between models like FICO and VantageScore may lead to confusion due to different scales. Scores tend to move in the same direction across systems, but the numerical values may vary.

Also, be aware that your score can fluctuate frequently. This is normal and reflects your ongoing financial activity.

When Credit Score Isn’t Enough

A high score doesn’t guarantee loan approval. Lenders also consider your income, debt levels, and financial history. You could have an excellent score but still be denied credit if your income is low or your existing debt is too high.

To maintain a healthy credit profile, aim to keep your credit utilization between 10% and 30% of your available credit, and maintain a debt-to-income ratio below 36%.

🛡️ Your Privacy Matters

Your trust is our top priority. We use industry-standard encryption to protect your personal information.

By submitting your details, you:

- Consent to having your inquiry reviewed by multiple lenders

- Agree to receive email or phone communications from matched lenders

- Can opt out of communications at any time

Read our Privacy Policy for full details.

📢 Responsible Borrowing Reminder

Personal loans can help with short-term financial needs, but they are not long-term financial solutions. Before accepting a loan:

- Evaluate whether you can repay on time

- Consider alternatives such as credit counseling or financial planning

- Only borrow what you can reasonably afford to repay

Late or missed payments may negatively impact your credit.

⚖️ Regulatory & Legal Compliance

We follow all applicable state and federal laws for lead generation and consumer protection. Some lenders in our network may be tribal lending enterprises (TLEs), which operate under federal and tribal laws and may not follow state-specific regulations. Be sure to review any loan offer carefully and understand the dispute resolution process, which may involve arbitration or tribal courts.

📝 Terms You Should Know

APR (Annual Percentage Rate):

This is the cost of borrowing on a yearly basis, including interest and any applicable fees. Review the APR carefully before accepting a loan offer.

Loan Term:

This is the length of time you have to repay the loan. It could be a few months or several years, depending on the lender.

Late Fees:

Fees charged by the lender if you miss a payment. Always read the full loan agreement to understand the consequences of late payments.

Prepayment Penalty:

Some lenders may charge a fee if you pay off your loan early. Check the fine print for any prepayment conditions.

🌐 Contact Us

If you have questions about our platform or how the process works, contact us:

Email: kpservices7874@gmail.com

Business Hours: Monday – Friday, 9am to 5pm EST

For loan-specific questions, you will need to reach out directly to the lender you were matched with.

🚀 Get Started Today

You’re just a few minutes away from exploring your loan options.

No commitment. No fees. Just a smarter way to connect with lenders.

Start Now with Confidence

Our platform is designed to connect you with real, reliable lending opportunities—all with no cost and no obligation. Whether you need funds for an emergency expense, home improvement, debt consolidation, or another purpose, we’re here to help you find the right loan options.

Submit your information now and get started on the path to financial flexibility—quickly, safely, and securely.